Experience Modification Rate (EMR) Calculator

What is an Experience Modification Rate?

A California experience modification is a rate factor given to eligible California employers annually by comparing an employer’s 3-year loss experience to the “average” for employers in the same classification. For example, a restaurant is compared only with other restaurants.

An experience modification rate, also known as an experience modifier rate, “x-mod”, or EMR rate is a debit or credit calculated by the Workers Compensation Insurance Rating Bureau (WCIRB) based on payroll size and the frequency and severity of an employer’s claims experience.

A high experience mod will increase your annual insurance premiums. A low experience rating will result in a credit (discount) to your annual premium.

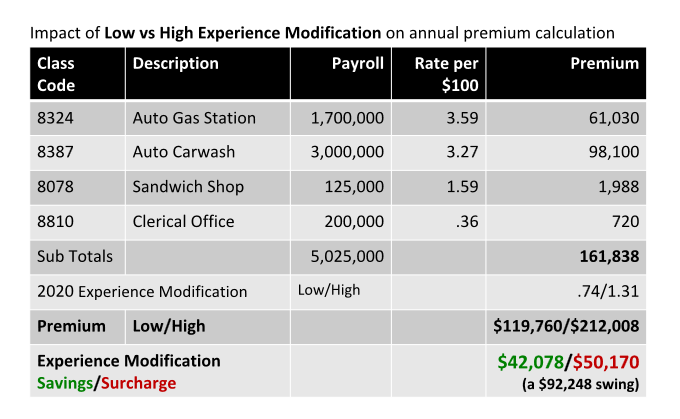

Workers compensation premiums are calculated as follows:

Annual Payroll x Workers Compensation Rate per $100 = Manual Premium

Manual Premium x Experience Modification = Final Premium

All businesses start with an experience modification, EMR, of 1.0. The modification rate varies annually for each business. One company may have a low mod rate of .55 while another company in the same line of business may have a mod rate of 3.0 as a result of their actual claim activity.

An insured is eligible for an EMR experience rating when the last policy year or the last two policy years of the experience rating period produced a premium of at least $11,000. If more than two years of data is used, an average annual premium of at least $5,500 is required.

Each workers comp insurance claim will affect your experience mod for at least 3 years.

The “claim amount” for experience modification purposes includes the actual dollar amount paid to the claimant and the "reserved" dollar amount held in anticipation of future payment on that claim.

What is the lowest possible Experience Modification (EMR rating)?

The lowest possible experience rating is the experience modification rate when calculated with zero claims for the entire 3 year experience period. This is often called the "minimum modification".

How can I lower my EMR ratings to reduce my premium cost?

Insurance carriers are trying to forecast "expected losses" when they review an application for work comp coverage. Underwriters consider actual losses and actual claims as a historic indicator of expected losses in the future.

An excellent starting point to lower work comp premiums is to engage a plan to reduce ex-mod ratings by lowering injury claims (the actual losses) in order to eliminate costs and present a favorable risk to insurance companies who will offer premiums based on the efforts made to reduce injuries and achieve zero claims results.

Calculating a minimum insurance x-mod is easy. An analysis report of the current experience modification rate will include the experience modification rate with no claims. VANTREO can provide you with the analysis report for your business very quickly. Not only does the analysis report show you the minimum experience modification rate but it also displays the estimated additional ex-mod insurance cost for all of the claims currently affecting your actual workers compensation pricing.

With the analysis of claims and the claims' impact on your EMR, a proven strategic plan to eliminate expected losses begins. It is a powerful way to lower time and expense throughout the organization.

What is a good EMR rating?

An EMR, experience modification rating, of 1.0 is considered the average for a particular industry. Any rating that is below 1.0 is considered a good EMR rating.

Of course, the goal is not to be simply below 1.0. The goal is to be as close to the organization's minimum modification (the modification with no claims in the 3-year rating formula).

How does the EMR calculation work?

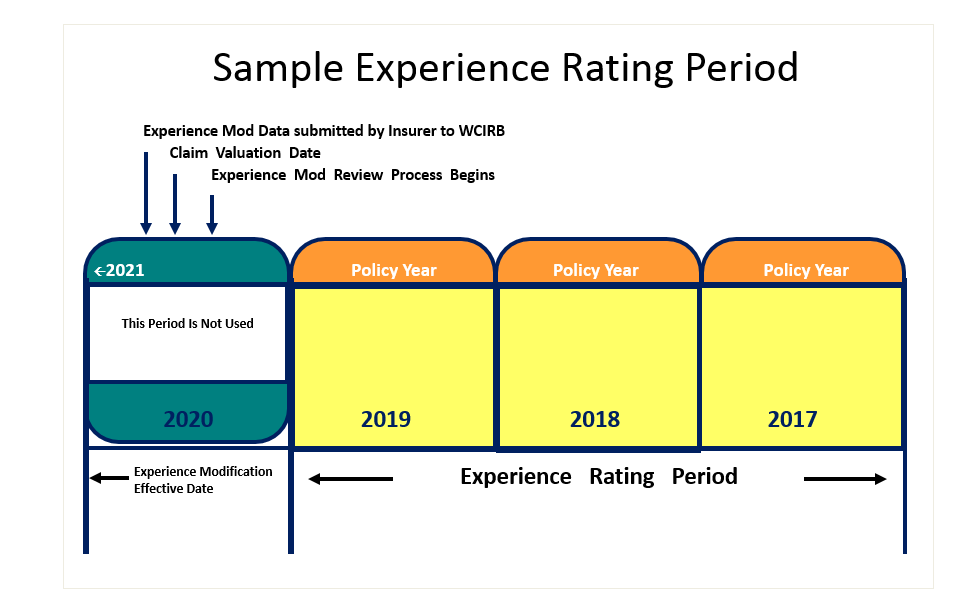

In general, experience modification rates are calculated on a rolling 3-year basis. Payroll and claim information stay in the formula for at least 3 years. Every year the oldest policy information drops out of the formula and the newest year joins in.

The most recent policy year (the year that is currently in progress) joins the formula once it is completed. For example, the payroll and claims information used to generate the 2021 x-mod includes 2017, 2018, and 2019 policy years. 2020 will not join the formula until the 2022 calculation. See the diagram below.

Ex Mod Rates: A Financial Incentive in California

California's workers' compensation experience rating system is a merit rating system intended to provide employers a direct financial incentive to reduce work-related accidents. The experience rating system objectively distributes the cost of workers' compensation insurance more equitably among employers assigned to particular industry classifications.

Employers that have fewer and less severe losses than others using the same classification codes typically pay less insurance premium.

If you are interested in paying less for workers compensation while taking excellent care of the people on your team, you’ve come to the right place.

VANTREO and our CompZone™ team have enabled hundreds of employers to realize substantially lower ex-mod ratings and to save millions of premium dollars.

We are just as proud to have helped ensure that thousands of workers continue to return home at the end of the day as healthy as they were when they arrived.

What causes high work comp rates?

Work comp rates are loss-sensitive. A claim that happens today results in additional premium for at least three years.

Base work comp rates are set by the Workers Compensation Insurance Rating Bureau (WCIRB) using forecasted future losses (both frequency and severity) by industry classification.

Employers paying at least $11,000 in premium are assigned an “experience modification” that compares their actual claims history with “expected losses” for their industry. The premium rate is adjusted accordingly. A high mod increases the rate. A low mod reduces the rate.

In addition, approximately 25% of EMR factors are incorrect or include erroneous information. Auditing EMR factors can help eliminate these, often costly, mistakes.

Do employers have any real control over workplace injury claims?

Workers compensation is the one insurance that business owners have the most control over. And yet, it’s the one insurance that too many employers feel victim to.

Work comp can become a mystery…a cost that seemingly cannot be predicted or prevented.

Nothing is further from the truth.

Almost all work comp claims are preventable when you are able to predict likely injuries and claims before they happen and cost premium for three years or more.

Is there a short-cut to stopping injury claims?

Absolutely.

It starts with an analysis of your current experience modification worksheet to determine what is driving your costs and how to deploy technology, training, and a unique approach to the work comp marketplace to reverse negative claim trend and improve results.

The good news is that we can confidentially get you a copy of your experience mod worksheet and provide a simple written analysis to help you begin to reduce costs. These two documents are complimentary to you…it’s our way of introducing ourselves and qualifying VANTREO to be your next-in-line insurance brokerage.

Your experience modification worksheet and analysis report will be provided without your having to change or even notify your current insurance broker unless you want to.

A business’ experience modification is a critical indicator and a cost reduction tool that should be actively worked on. Significant premium savings are often possible even if your x-mod is below 1.00.